The U.S. stock market can’t seem to figure out whether the recent decline in Treasury yields is good or bad for equities, according to DataTrek Research.

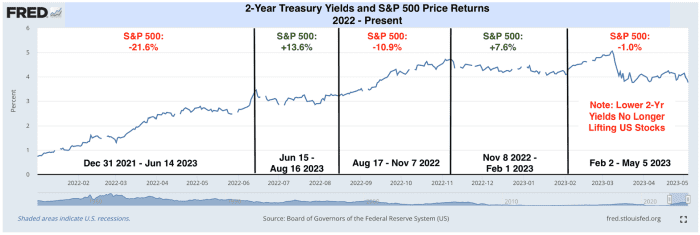

“The tie between 2-year yields and S&P 500 returns is mostly clear” over the past 16 months, Nicholas Colas, co-founder of DataTrek, said in a note Monday. “When rates are rising, the index drops. When rates stabilize, the S&P rallies.”

But Colas spotted a recent break in the relationship between Treasury yields and equities, where lower two-year rates were “no longer lifting U.S. stocks.” The far right section of the chart below shows two-year Treasury yields fell in the period running from Feb. 2 through Friday to 3.92% from 4.09%, but the S&P 500 was down 1% over the same stretch, according to DataTrek.

“Since 2-year Treasury yields reflect the market’s view of future Federal Reserve monetary policy, it is telling that their recent decline has had little effect on stock prices,” Colas said. “Even though fed funds futures are predicting rate cuts by the end of the year, equity markets are not quite sure if that’s good news or bad.”

Last week, the Fed raised its benchmark rate by a quarter percentage point to a target range of 5% to 5.25%. The central bank aggressively hiked rates from near zero a little over a year ago in an effort to fight stubbornly high inflation.

Traders of fed-funds futures last week expressed a greater chance of the Fed cutting its benchmark rate by the end of the year, said Colas. Their view seems tied to “ongoing problems in U.S. regional banks and already slowing U.S. economic growth” potentially forcing “the Fed’s hand later this year.”

U.S. stocks were trading mostly modestly lower Monday morning as investors awaited the Fed senior loan officer opinion survey on bank lending practices. The S&P 500

SPX,

The Fed’s loan survey will be released at 2 p.m. Eastern Time.

Meanwhile, Treasury yields were rising Monday morning, with the two-year rate

TMUBMUSD02Y,

Read: U.S. markets fear recession and see interest rate cuts ahead as Fed loan survey looms