Lockheed Martin Corp. became the latest U.S. issuer to tap the corporate-bond market ahead of any potential market fallout from the U.S. debt-ceiling fight, with a $2 billion offering that priced on Wednesday.

The deal has boosted Lockheed’s

LMT,

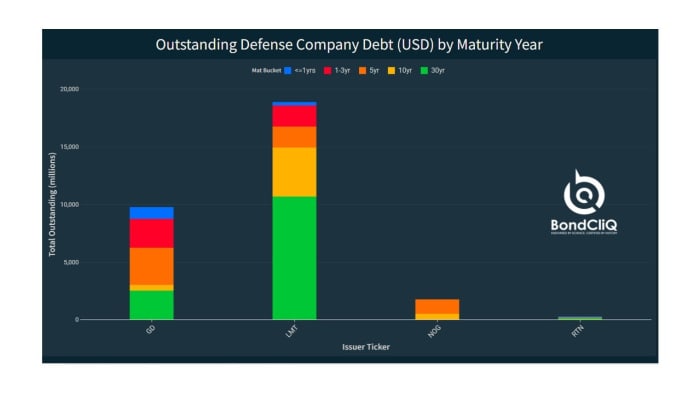

As this chart from data provider BondCliQ shows, Lockheed’s debt far exceeds that of its three main competitors: General Dynamics Corp.

GD,

Outstanding defense company debt.

BondCliQLockheed offered $500 million worth of 4.45% five-year bonds, $850 million worth of 4.75% 10-year bonds and $650 million worth of 5.20% 30-year bonds.

The new notes were trading around where they priced in a down market on Thursday, according to BondCliQ.

Lockheed joins a slew of issuers that have hit the market in recent weeks, eager to avoid any fallout from the debt-ceiling standoff, which continued on Wednesday.

Pfizer Inc. secured $31 billion in financing on May 16 via an eight-tranche bond deal that is the fourth-largest on record for the U.S. investment-grade corporate-bond market, according to data from Informa Global Markets.

The money is earmarked for the company’s roughly $43 billion acquisition of Seagen, a biotech focused on creating therapies to treat cancer, according to public documents tied to the financing.

Last week, Charles Schwab Corp. issued $2.5 billion in investment-grade bonds, split between a six-year and 10-year tranche.

U.S. Treasury Secretary Janet Yellen expressed concerns Wednesday about how financial markets are getting hit by debt-limit angst and also said it’s “almost certain” that the federal government won’t be able to meet all of its obligations in early June if Congress doesn’t raise the ceiling for borrowing, as MarketWatch’s Victor Reklaitis reported.

She added that she aims to provide a fresh update on the debt-limit deadline “pretty soon.”

“I will plan to update Congress shortly and try to increase the level of precision,” Yellen said, as she responded to questions about the debt-ceiling standoff during the Wall Street Journal’s CEO Council Summit.