“‘Speculators, like in any market they are there to stay, I keep advising them that they will be ouching — they did ouch in April. I don’t have to show my cards — I’m not a poker player. … But I would just tell them to watch out.’”

— Prince Abdulaziz bin SalmanSaudi Arabia’s energy minister delivered that stark warning to traders betting on falling oil prices while speaking Tuesday at an economic forum in the Qatari capital Doha, Reuters reported. It comes as members of the Organization of the Petroleum Exporting Countries and its allies — known together as OPEC+ — prepare for an early June meeting in Vienna.

Saudi Arabia and its OPEC+ allies shocked oil traders on Sunday, April 2, announcing ahead of the opening of the U.S. futures market around 1.15 million barrels in additional production cuts beginning in May. At the time, Russia said it would continue cuts of 500,000 barrels a day relative to February output through year-end.

Oil prices duly spiked, with West Texas Intermediate and Brent crude both jumping back above the $80-a-barrel level. Gains accelerated as shorts — traders who bet on a fall in prices — were forced to buy futures to get out of losing positions, contributing to a short-covering rally.

Prices retreated by month’s end, however, more than erasing the gains to enter May trading below levels seen ahead of the announcement.

Oil futures rose on Tuesday, with West Texas Intermediate crude for July delivery

CL.1,

Crude price weakness has been tied to worries over the economic outlook, which has overshadowed optimism on demand and expectations for the oil market to move into a physical deficit in the second half of this year.

Crude futures were building on those gains early Wednesday, with WTI up 1.6% and Brent adding 1.4%.

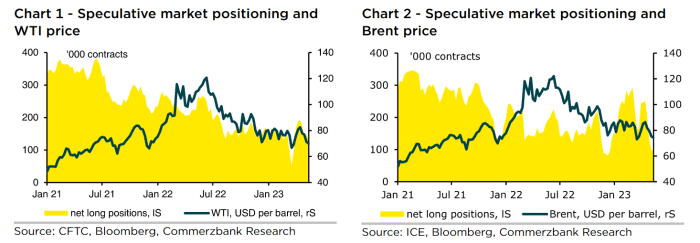

Positioning data for West Texas Intermediate and Brent crude futures may be helping to feed Abdulaziz’s ire, said Carsten Fritsch, a commodity analyst at Commerzbank, in a Tuesday note.

Both show a significant fall in speculative net long positions — bets that prices will rise — over the last four weeks, Fritsch wrote (see charts below).

The number of net long Brent positions held by speculative traders stood at just 90,600 contracts as of May 16, Fritsch said, citing ICE data, down from 252,900 four weeks earlier. The decrease corresponds to sales equating to 162.3 million barrels of crude, or 5.8 million barrels a day, he said.

U.S. Commodity Futures Trading Commission data shows a smaller drop in net long WTI positions, but the reduction was still equal to 60 million barrels, or 2.1 million barrels a day, Fritsch said.

“To the displeasure of the Saudi Arabian energy minister, the speculative selling is thus likely to have played its part in the price weakness in recent weeks. It remains to be seen,” Fritsch said, “whether his warning will bring about an upswing in prices sparked by short covering.”