Pharmaceutical giant Pfizer secured $31 billion in financing on Tuesday, as companies pick up the pace of borrowing ahead of potential market turmoil tied to the U.S. debt-ceiling fight.

Pfizer

PFE,

Pricing on the bonds, rated A1 by Moody’s Investors Service, narrowed about 20 basis points from initial expectations, with the $5 billion class of 10-year bonds clearing at a spread of 125 basis points above the risk-free Treasury rate

TMUBMUSD10Y,

Bankers initially pitched the bonds to investors at a range of Treasurys plus 145 basis points, according to CreditSights. Lower spreads mean investors receive less compensation.

The bond deal ranks as the fourth-largest on record for the U.S. investment-grade corporate bond market, according to data from Informa Global Markets.

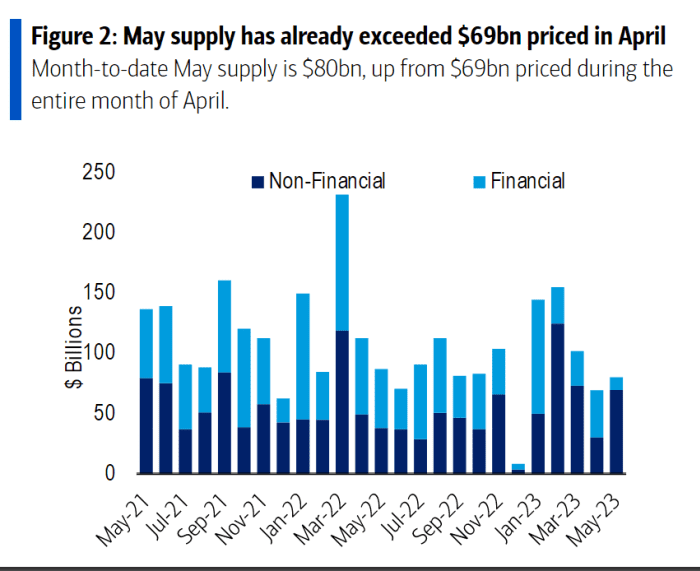

Analysts at BofA Global this week noted an uptick in U.S. investment-grade corporate bond supply, with issuance in May (see chart) already exceeding the $69 billion priced in April.

Corporate bond supply is picking up ahead of June, when the U.S. is expected to be unable to pay all of its bills without a debt-ceiling deal in Washington.

BofA GlobalWhile the chart doesn’t include Tuesday’s mega financing for Pfizer, it does show the dramatic drop in issuance volume in March from a year ago, when the Federal Reserve began to quickly raise rates from nearly zero. It also shows May issuance increased from a month before.

“The acceleration this week could be, at least in part, due to the upcoming U.S. debt-limit X-date in early June,” a team of BofA Global researchers, led by Yuri Seliger, wrote in a recent client note.

Pfizer didn’t immediately respond to a request for comment. Its shares closed 0.4% lower Tuesday.

Treasury Secretary Janet Yellen in early May said the U.S. could be unable to pay all of its bills by June 1, a warning she repeated earlier this week.

After a second round of debt-ceiling talks between President Joe Biden and congressional leaders Tuesday, House Speaker Kevin McCarthy said disagreements remain but that a deal might be possible by the end of the week.

Stocks closed lower on Tuesday, with the Dow Jones Industrial Average

DJIA,