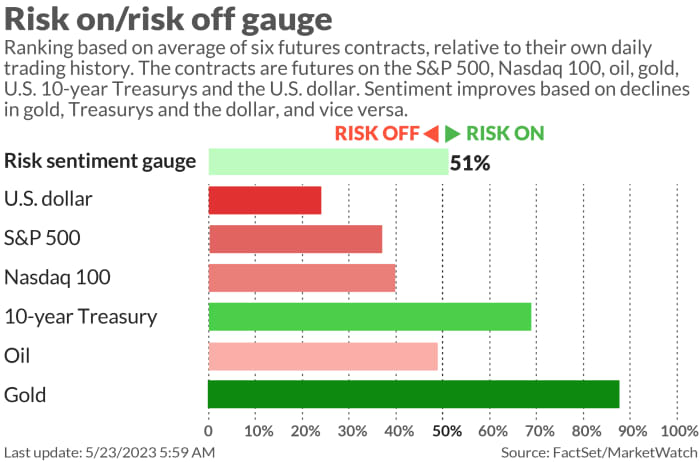

Markets ripped a page right out of The Lego Movie songbook on Monday, with an “Everything-is-awesome,” session — the highest close for the Nasdaq COMP since August, and continued falling demand for 2-year Treasury bonds and gold.

It’s as if investors are watching the U.S. debt ceiling saga like “an American film knowing that there will eventually be a happy ending,” says Swissquote Bank’s Ipek Ozkardeskaya. For Tuesday, equities are wobbling as Washington watch continues.

Onto our call of the day from Prometheus Research, which sees promise in a strategy that’s bullish on stocks and bearish on commodities.

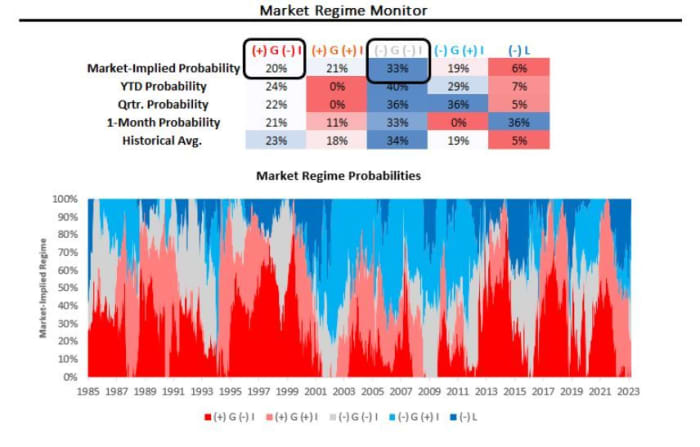

“The combination of these bets is particularly interesting in a macroeconomic context— if they continue to trend, it will likely further current market pricing of disinflation,” says Prometheus, whose researchers use quantitative analysis to understand underlying mechanisms driving the economy that can indicate future market trajectories.

Read: 4 reasons the stock market keeps climbing in 2023 as S&P 500 attempts another push above 4,200

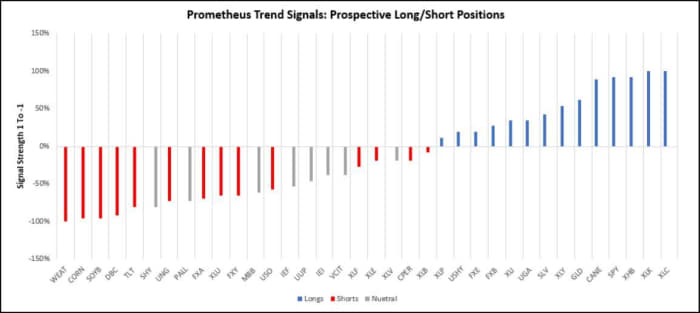

The below chart offers a summary of the potential long, short and neutral asset positions based on their trend process:

“Currently, we are seeing a range of potential trends — most of which are skewed the short side. The strongest signals are currently short commodities (WEAT WEAT, CORN C00, SOYB SOYB, DBC DBC ) and long equities (SPY SPY, XHB XHB, XLK XLK, XLC XLC ),” said the Prometheus team.

The takeaway is that if these trends keep up, investors could see the market keep pricing towards deflation. And their market regime monitor is indicating a rising probability of low growth, low inflation (third column over, in blue) ahead:

The Prometheus view fits with the economic outlook expressed by Steve Englander, head of North American macro strategy at Standard Chartered, who looked at tax receipts for May. “We think inflation and the economy are decelerating more than many in the market and at the Fed believe,” he said.

Also read: Stocks were the only positive asset class over the last decade, adjusted for inflation

The markets

Stocks SPX DJIA COMP are lower , as bond yields BX:TMUBMUSD02Y push higher, with the 10-year BX:TMUBMUSD10Y up 3 basis points at 3.73%. Two-year bond yields are up a 9th straight session after hawkish Fed talk. Oil CL is flat and gold GC00 and silver SI00 are falling as the dollar DXY moves up.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Lowe’s LOW stock is down after the home-improvement retailer cut full-year guidance, citing lower demand, while BJ’s Wholesale Club BJ, is lower after confirming its outlook, but disappointing on sales, and AutoZone AZO is dropping on disappointing sales from the car-parts retailer. Dick’s Sporting Goods DKS stock jumped after an earning and sales beat. Intuit INTU, Agilent A and VF Corp. VFC due after the close.

Read: Parade of retailers to face inflation doubts while Nvidia and Zoom answer questions about tech

Yelp shares YELP are up 13% after the Wall Street Journal reported that an activist investor is pushing the company to consider a sale to boost its value.

Shutterstock SSTK is buying GIF and stickers group Giphy from Meta Platforms META for $53 million in cash. Neither company’s shares are moving much in premarket.

Lordstown Motors RIDE set a 1-for-15 reverse stock split. Shares are down 16% in premarket.

Cathie Wood’s ARK Investment loaded up on about $4 million worth of Palantir Technologies stock PLTR across multiple funds on Monday.

“There is a subset of American consumers who will not drink a Bud Light for the foreseeable future,” says JPMorgan, which warns of trouble for Anheuser-Busch’s BUD BE:ABI U.S. profits.

The S&P flash U.S. services and manufacturing PMI surveys showed faster economic growth in May, while new-home sales rose to 683,000 in April annually, from a revised 656,000 in the prior month. Dallas Fed President Lorie Logan was also due to speak in the a.m.

Read: Will AI cause mass unemployment? What history says about technology and jobs

Best of the web

Kite surfing, ice baths and 8-mile morning runs: How some CEOs stay in shape

First Citizens has accused ex-SVB employees of a plot to ‘plunder’ secrets in an HSBC lawsuit

The man who spends $2 million a year to look 18 is swapping blood with his father and son

Russia is fighting an alleged cross-border raid for a second day that Kyiv says was carried out by Russian rebels

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

| TSLA | Tesla |

| GME | GameStop |

| AMC | AMC Entertainment |

| NIO | Nio |

| BUD | Anheuser-Busch InBev |

| NVDA | Nvidia |

| AAPL | Apple |

| MULN | Mullen Automotive |

| AMZN | Amazon.com |

| PACW | PacWest Bancorp |

Random reads

Humans never outnumbered sheep in New Zealand until now.

Train delays? Drunk passenger to the rescue.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton