Stock-market investors are soon facing a reconstitution of U.S. Russell indexes, an annual process resulting in the deletion and addition of companies in widely-followed benchmarks.

Almost $4 trillion of assets under management is benchmarked to major Russell indexes, which are set to be rebalanced after the stock market’s close on June 23, according to a Goldman Sachs Group research report published Monday evening.

FTSE Russell plans to release on May 19 a preliminary list of additions and deletions of companies under the annual rebalancing. Updates will be provided ahead of reconstitution day, which “typically concludes as one of the highest trading volume days of the year,” according to a FTSE Russell note posted on the firm’s website on May 15.

“Our analysis suggests 23 additions to the Russell 1000,” as well as 287 additions to the Russell 2000 and 163 deletions from the Russell 3000, the Goldman analysts said in their report.

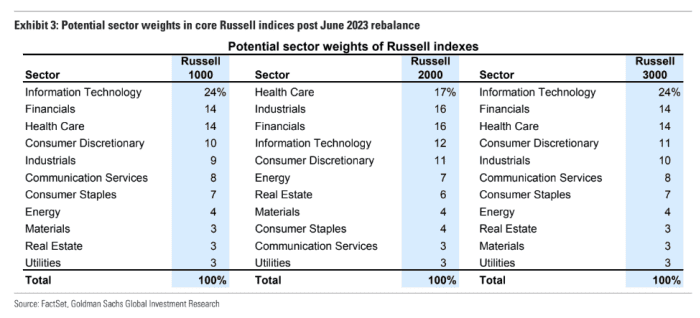

“We estimate Info Tech will remain the largest sector in the Russell 1000 and Russell 3000,” they said. While information technology will see the largest increase in weight in the Russell 2000 index, healthcare will remain its largest sector, according to their report.

In the chart below, Goldman highlighted the potential sector weights in core Russell indexes after they’re reconstituted in June.

Goldman forecasts the 23 new stocks that may be added to the Russell 1000

RUI,

The Russell 1000 index, a gauge of large-cap stocks in the U.S., has risen around 7% so far this year based on Tuesday afternoon trading, according to FactSet data. By contrast, the small-cap-focused Russell 2000 index is down around 1.1% year to date, FactSet data show, at last check.

Goldman estimated that Facebook parent Meta Platforms Inc.

META,

Google parent Alphabet Inc.

GOOGL,

“The largest potential weighting decrease” in the Russell 1000 Growth index may be Microsoft Corp.

MSFT,

The Russell 1000 Growth index

RLG,

Goldman expects Walmart Inc.

WMT,